Court document shocker:Unsettling Doral numbers: Owners borrowed $75 million, still owe $58.6 million plus interest

June 27, 2019 at 8:16 a.m.

The court documents unsparingly tell the story.

Doral Arrowwood’s current owners, DCCA, back on Jan. 12, 2005, put all their then current loans in one package, took on more debt, and signed documents borrowing $75 million on their property.

The entire loan was due to be repaid on Feb. 1, 2015.

On Mar. 14, 2019, the lender, as part of a foreclosure proceeding, said in signed court documents that it was owed “$58,621,335.36 plus accrued but unpaid interest” (“at a total default rate of 11.2%”).

What led up to that moment is equally dramatic.

Unable to meet the Feb. 1, 2015 date, DCCA persuaded lenders to agree to a “Loan Modification and Reinstatement Agreement” extending the maturity date to Feb. 1, 2018. That maturity date was then further extended to Feb. 1, 2020.

But the loan documents, according to a court filing from U.S. Bank and its fellow lenders dated Mar. 14, 2019 with the State Supreme (Civil) Court in White Plains, say DCCA’s responsibility went beyond repaying the loan on time, and included assuring that “the property (Doral Arrowwood Hotel & Conference Center) is in good condition, order and repair in all respects to its use, operation or value” which … “Borrower has breached ... allowing the Mortgaged Property to fall into a state of disrepair exhibited by, inter alia, mold issues in and around guest bathrooms due to unclean air vents, unsightly potholes, cracks in carpeting, broken machines and objects, ineffective security cameras, poor lighting in parking lots, property ground and pedestrian sidewalks, violations with fire extinguishers, fire exits, blocked stairwells, water damage on and around radiators, hot water issues, plumbing issues…”

The court filing by U.S. Bank, on behalf of all lenders, also says that DCCA failed to report to the lender that “the value of the mortgaged property has plummeted in excess of $20,000,000.”

How and whether DCCA will be able to pay back its loan and settle with its lenders probably won’t be known for months.

In the meantime, the Westmore News continues to look into all aspects of Doral relationships with the Westchester Industrial Development Agency (WIDA), which is named in the court foreclosure documents and legally holds title to the property, even though, as WIDA’s attorney Alan Fox claims, it has no financial responsibility for the property and that being named title holder in the court documents is merely a technicality.

Shortly after our story on WIDA being unable to find any documents relating to its role in providing tax breaks for the construction of the Pfizer Center at Doral was published June 13, 2019, Westchester County Chief of Communications Catherine Cioffi contacted the Westmore News, said the documents had suddenly been found, and told us to show up the following Tuesday at 9:30 a.m. to read them.

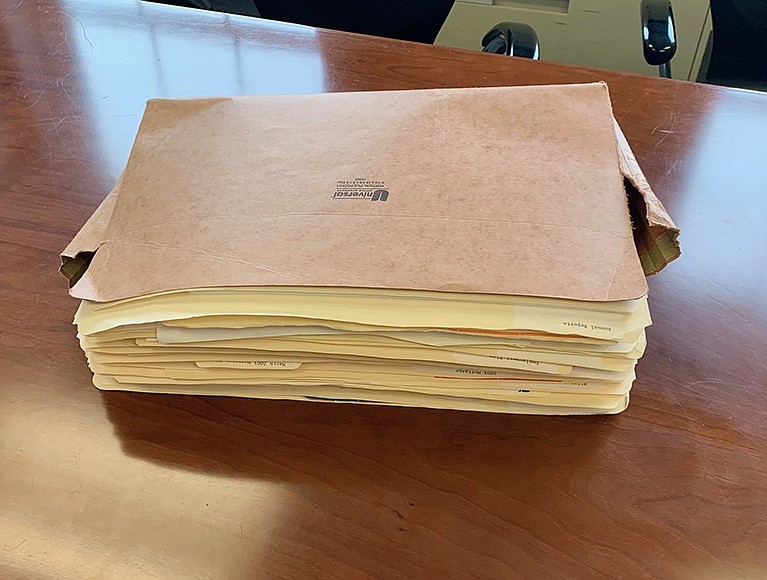

When we arrived, we found a thick folder waiting for us in the conference room attached to Cioffi’s office but she told us we had only one hour to review the file, could make no photocopies, but could take iPhone photos.

We were able to ascertain that the file ended in 2005 and that no records were provided from 2005 until the current foreclosure proceedings in State Supreme Court. We have since requested, under the State Freedom of Information Law (FOIL), that the rest of the files be produced and that we have as much time as we need to review and study the provided records.

In the meantime, we have been in dialogue with Receiver Kirby Payne, who is responsible for running the property.

The loan documents show DCCA was responsible for paying back the entire Pfizer Center loan plus any loans taken out on the Hotel and Conference Center and its grounds.

Payne has confirmed that “separate financials are not kept for the facility as it is operated as an integral part of the Doral Arrowwood just like all of the hotel’s other meeting space. The various meeting rooms in the building, which is connected to the remainder of the Doral Arrowwood in three places, are used on almost a daily basis by the various conference and social groups that patronize the hotel’s facilities.”

The Pfizer Center has been without a long-term tenant since Pfizer departed when its lease expired in 2015. Most recently there was the prospect of a lengthy tenant in the form of a sales and showroom for the Brightview senior living facility to be built at Purchase College. But they were not allowed to sign any kind of long-term lease because, as Payne told the Westmore News, “The hotel’s owners stopped negotiating with them prior to the Receivership because they anticipated the Receivership. The Receiver order precludes the Receiver entering into contracts lasting longer than 12 months which they required if they were going to build a model apartment.”

Brightview moved out and relocated to the George Comfort & Sons managed office building at 1100 King St.

The entrance to the Brightview temporary facilities at Doral’s now-defunct Pfizer Learning Center was located at the main entrance to the facility, off the Doral main parking lot.

Since Brightview’s departure, entrance to the former Pfizer facility is only through the Doral Arrowwood Hotel’s access corridor. The impression is that the defunct Pfizer Center is but an adjunct to the main Doral building. And it remains so until further notice.

Comments:

You must login to comment.